Social Security Reform

"Social Security is like a car with a flat tire. We need to fix the flat tire, but we don't need to replace the car." - Peter Orzag, Brookings Institute

Duped by Dubya - yet again. When will this stop?

On this page:

President Bush Answers a Question about his Social Security reform plan

Host Rant

Host Rant Revisited

Privatizing Social Security (when a lie becomes accepted wisdom)

What Bush did and didn't say...

Bush Claims vs. The Facts

Don't Believe the Hype - a complete reference guide to the healthy status of Social Security

To Preserve and Strengthen Social Security: Religious Organization Statement of Principles

Center for Economic and Policy Research (CEPR.net) - Basic Facts pdf file

Fox News deception - FDR Social Security quote distortion to fit Bush's plan to phase out Social Security

The Cost of Propaganda - Near $1 million spent to spread misinformation about the state of Social Security

Honor Your Father and Mother - an open letter to members of the Senate and Congress

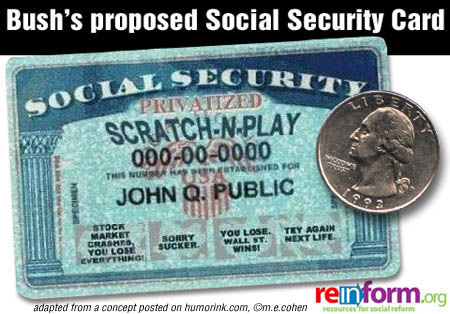

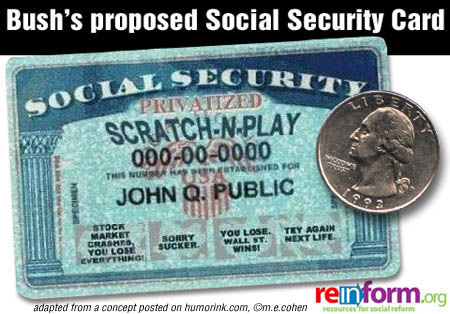

Click here to watch a flash animation outlining the problems with Bush's proposal to privatize Social Security.

Bush's Real Goal: Gut Social Security - Jim Hightower

The President explains the virtues of his Social Security plan,

Tampa, FL, Feb. 4, 2005

Woman in Audience: I don't really understand. How is it the new [Social Security] plan is going to fix that problem?

Here is President Bush's verbatim response:

President Bush: Because the - all which is on the table begins to address the big cost drivers. For example, how benefits are calculated, for example, is on the table. Whether or not benefits rise based upon wage increases or price increases. There's a series of parts of the formula that are being considered. And when you couple that, those different cost drivers, affecting those -- changing those with personal accounts, the idea is to get what has been promised more likely to be -- or closer delivered to that has been promised. Does that make any sense to you? It's kind of muddled.

Look, there's a series of things that cause the - like, for example, benefits are calculated based upon the increase of wages, as opposed to the increase of prices. Some have suggested that we calculate -the benefits will rise based upon inflation, as opposed to wage increases. There is a reform that would help solve the red if that were put into effect. In other words, how fast benefits grow, how fast the promised benefits grow, if those -if that growth is affected, it will help on the red.

We hope that helps explain it for you...

Return to top of page

Rant I: Social Security Reform Scam

When a lie is repeated often enough, it becomes accepted wisdom.

This seems to be the modus operandi of the Bush administration. And now, they're using another set of carefully constructed lies to "fix" our social security system (which, according to the nonpartisan Social Security trustees charged with overseeing the health of this vital program, is quite healthy and in no need of fixing).

Remember the adage "If it ain't broke, don't fix it?" The Bush administration easily can look at these reports and see that Social Security isn't really in need of overhauling. What then could their motivation be? Are they really concerned with the well-being of future Social Security recipients? Guess again. If Social Security is privatized, Wall Street investment firms stand to make billions of dollars in commissions on the resultant trades.

When are we going to wise-up and realize that the overriding motivation behind almost every initiative this administration has created (even though cleverly worded to sound like they're in OUR best interest) is more opportunity for the rich to make even more money, and less opportunity for those trapped in poverty to have a fighting chance.

If we can't have real conservativism, could we at least start seeing some compassion?

- Tim Nyberg, Liberalware.com host

Return to top of page

Rant II: Social Security Reform Scam

According to the experts, our Social Security system in NO need of repair. The privatization that Bush is promoting would only serve to widen the gap between the halves and have-nots. The number of those forced to live in poverty would increase while the pockets of stockbrokers and investment firms will be lined with riches that rightfully belong to hard-working Americans. Administrative costs of Bush's "fixed" Social Security System would jump from their present .6% up to 20%. It just doesn't and shouldn't make sense to anyone who is allowed to hear the facts.

Furthermore, I resent President Bush's tour to promote this scam being paid for out of our tax dollars. There are REAL problems that need tending to that are being virtually ignored while Bush's "Cry Wolf Tour" is being executed.

This administration is weakening America. It is weakening our education system, our social programs, our economy, our families, our hopes for a better tomorrow, and it is weakening our image around the globe. It's time that America woke up and removed this misguided pawn, this weak, lying, NeoCon lapdog from the highest office in the land. It's time for American's to get informed and demand control of THEIR government.

STOP the CRY WOLF TOUR! IMPEACH BUSH! He is killing America.

- Tim Nyberg, Liberalware host

Read more from the Center for Economic and Policy Research (CEPR.net):

Center for Economic and Policy Research - Click to download a basic Facts pdf file

Return to top of page

Privatizing Social Security

If a lie is repeated often enough, it becomes accepted wisdom.

by Harry C. Kiely

How many times can President Bush get away with crying wolf? First came the "weapons of mass destruction." Congress believed him and committed our nation to a tragic war in Iraq, based on lies and deception. Then there were the massive tax cuts for the rich, guaranteed to get the economy going again. The result? The budget surplus was traded in for a giant deficit to be passed on to our grandchildren.

How many times can President Bush get away with crying wolf? First came the "weapons of mass destruction." Congress believed him and committed our nation to a tragic war in Iraq, based on lies and deception. Then there were the massive tax cuts for the rich, guaranteed to get the economy going again. The result? The budget surplus was traded in for a giant deficit to be passed on to our grandchildren.

With Social Security, the president is at it again. The whole system is moving into crash mode, he says, so we need to take radical steps to rescue it. (Question: Why did the president wait until after the big tax cuts to go into panic about Social Security?)

Let’s get one fact straight right now. Social Security is not only not in jeopardy, it is in fact healthy and robust. The authority for this assertion is none other than the nonpartisan Social Security trustees, whose job it is to monitor this vital program. According to the trustees, the Social Security trust fund can pay full benefits through 2042. The Congressional Budget Office, also nonpartisan, goes beyond that and sees full solvency through 2052. Long before reaching those projected deadlines, minor course corrections can be applied and assure the Social Security program for an indefinite period.

If we pay attention to our common life, we know that if a lie is repeated often enough, it becomes the accepted wisdom. Such has been the case with Social Security. For 20 years, the Wall Street investment industry has been disseminating reports about the imminent shortfall of Social Security when the baby boomers start retiring. So pervasive has been this disinformation campaign that reporters for the mainstream media treat it as common knowledge. Today, many workers under age 40 believe Social Security will not be there for them when they retire.

WHY WALL STREET’S sudden interest in ordinary people, including the millions who have been kept out of poverty through Social Security support for seven decades? The answer is simple: profit. Servicing the accounts made possible by partial privatization would net the investment firms many billions of dollars.

But privatization would be a disaster for the Social Security program. As it now works, Social Security is a social insurance program that guarantees an annual income for life for retirees and for the disabled. Conversion of even part of the present program to an investment program would automatically cut back on the guarantee and subject the investment portion to the risks of the market. The purpose of Social Security is to provide not wealth but security. Most people on Social Security say they like it that way and that they would not favor risking the loss of that guarantee.

A warning was provided last year when the Medicare prescription drug plan was rammed through Congress with virtually no debate. That bill was written mostly by lobbyists for the pharmaceutical companies and HMOs. The legislation for "saving" Social Security inevitably will be strongly influenced by companies that will profit through its conversion.

The bottom line: If we want to assure that Social Security will continue on its present path of providing a guaranteed secure income for retirees, survivors, and the disabled, we are going to have to fight for it. The "guarantee" is no longer guaranteed.

Harry C. Kiely, a United Methodist clergy, is a retiree who has a vested interest in the continued health of Social Security.

Privatizing Social Security. by Harry C. Kiely. Sojourners Magazine, March 2005 (Vol. 34, No. 3, pp. 7). Commentary.

(Source: http://www.sojo.net/index.cfm?action=magazine.article&issue=soj0503&article=050341a)

Return to top of page

What Bush did and did not say about his Social Security plan

BY ROBERT A. RANKIN 2/3/05

Knight Ridder Newspapers

WASHINGTON - (KRT) - President Bush devoted lots of attention in his State of the Union address to his proposal for new personal investment accounts, which he said would help improve the future financial stability of Social Security.

The president was selling a fundamental change to Social Security involving many complex parts. Like any good salesman, he was putting the best face on his plan, and he didn't mention many other aspects of it that would result in greater federal debt and lower Social Security benefits for many Americans. Here is some of what the president didn't say:

• Bush said that unless changes are made, Social Security is headed for bankruptcy. He didn't say that Social Security actuaries project that the system can pay full retirement benefits until 2042 without making any changes, and that after that, annual revenues will be sufficient to cover 73 percent of benefits. The nonpartisan Congressional Budget Office says the system will be able to pay full benefits until 2052 without any change.

• Bush said he'd let younger workers pay for their new investment accounts by diverting part of the taxes they now pay on their wages into stocks and bonds that they'd own. He didn't say that every dollar that was diverted into the new personal accounts would be taken away from paying Social Security benefits for today's and tomorrow's retirees and would have to be made up by massive federal borrowing.

• Bush said that fixing Social Security permanently would require a careful review of the options. He didn't say how he'd pay for the transition costs of moving from today's Social Security system to one that includes new personal-investment accounts, although White House aides said Wednesday that they planned to borrow about $750 billion for that. That would cover transition costs of phasing the system in from 2009 through 2015. Bush and his aides didn't say that Social Security's actuaries estimate that the price tag could be $2.2 trillion in the first decade and $4.5 trillion in the second decade of full operation. That would be added to the national debt. The plan would increase the debt annually for about 60 years.

• Bush said his new personal accounts would permit their owners to build wealth. He didn't say that those accounts would do nothing to fix Social Security's projected funding gap between tax revenues and the cost of retirement benefits. White House aides said Wednesday that a worker's traditional Social Security benefits would be reduced proportionately to offset the cost of his new account, but Bush didn't mention reducing traditional benefits. The new accounts would be outside of Social Security's structure as we know it, and they wouldn't pay for traditional Social Security benefits promised under existing law.

• Bush rules out raising taxes to fix Social Security's future finances. He didn't say that means the only way left to bring Social Security's future income and costs into balance is to reduce future benefits.

• Bush said he'd work with Congress to bring fiscal balance to Social Security. He didn't mention that his aides are weighing whether to propose a big benefit cut for future retirees. The cut is called "price indexing." It would change the formula for raising future retirement benefits. Current benefits rise in line with an index that ties them to the rise in average annual wages. The shift would replace that index with one tied to the rise in annual prices. Because wages tend to rise faster than prices, this shift would result in a benefit reduction of 26 percent for average wage-earners who retire in 2042, and of 46 percent for average wage-earners who retire in 2075, according to Social Security actuaries.

Return to top of page

Claims vs. Facts

How to Talk to a Conservative About Social Security

by Think Progress

from Alternet 02/14/05 online at: http://www.alternet.org/story/21244/

The White House and their deep-pocketed allies have launched a $35 million public relations effort to spread misinformation about President Bush’s Social Security privatization scheme. This fact sheet will arm you with all the facts you’ll need to take them on.

Fiscal Outlook

Claim: “By the year 2042, the entire system would be exhausted and bankrupt.” [President Bush, 2/2/05]

Fact: In 2042, enough new money will be coming in to pay between 73-80 percent of promised benefits. Even with this reduction, new retirees will still receive more money, in inflation-adjusted dollars, than today’s beneficiaries. [The Washington Post, 2/5/05]

Claim: “In the year 2018, for the first time ever, Social Security will pay out more in benefits than the government collects in payroll taxes.” [President Bush, 12/11/04]

Fact: “In 14 of the past 47 years, including 1975 to 1983, Social Security paid out more in benefits than the government collected in payroll.” [MSNBC, 1/14/05]

Fact: Under Bush’s plan, expenditures will begin to exceed revenues even earlier, in 2012. [The New York Times, 2/4/05]

Claim: “Under the current system, today’s 30-year old worker will face a 27 percent benefit cut when he or she reaches normal retirement age.” [GOP Guide to Social Security Reform, 1/27/05]

Fact: According to the Congressional Budget Office, younger workers would receive better benefits from Social Security as it exists now, even if nothing changes, than from President Bush’s private accounts plan. [Economic Policy Institute, 2/05]

The President’s Plan / Private Accounts

Claim: “As we fix Social Security, we also have the responsibility to make the system a better deal for younger workers. And the best way to reach that goal is through voluntary personal retirement accounts.” [President Bush, 2/2/05]

Fact: Analysis of the plan so far does not prove the accounts would be a better deal for anyone not working on Wall Street. Workers who opt for the private accounts would recover forfeited benefits through their accounts only “if their investments realized a return equal to or greater than the 3 percent earned by Treasury bonds currently held by the Social Security system.” But CBO factors out stock market risks to assume a 3.3 percent rate of return. With 0.3 percent subtracted for expected administrative costs on the account, “the full amount in a worker’s account would be reduced dollar for dollar from his Social Security checks, for a net gain of zero.” [The Washington Post, 2/4/05]

Claim: “You’ll be able to pass along the money that accumulates in your personal account, if you wish, to your children or grandchildren.” [President Bush, 2/2/05]

Fact: Most lower-income workers will be required to purchase government lifetime annuities, financial instruments that provide a guaranteed monthly payment for life but that expire at death. Money in these annuities cannot be passed on to heirs. [The New York Times, 2/3/05]

Claim: “We must pass reforms that solve the financial problems of Social Security once and for all.” [President Bush, 2/2/05]

Fact: “A Bush aide, briefing reporters on the condition of anonymity [said] that the individual accounts would do nothing to solve the system’s long-term financial problems.” The long-term gap in revenue would “have to be closed through benefit cuts that have yet to be detailed.” [LAT, 2/3/05; The Washington Post, 2/5/05]

Claim: “A personal account would be your account, you would own it, and the government could never take it away.” [President Bush, 2/8/05]

Fact: Bush’s Social Security plan is a far cry from the private ownership he’s touting, however. For example, instead of private plans that let Americans control their own investments, there are tight restrictions on which conservative stocks and bonds the public will be allowed to buy. And, as The New York Times reports, “the more restrictions there are, the harder it would be for people to achieve the outsized returns the administration has generally promoted to sell the public on private accounts.” [The New York Times, 2/6/05]

Claim: “Best of all, the [private] accounts would be replacing the empty promises of government with the real assets of ownership.” [President Bush, 2/8/05]

Fact: Social Security trust funds “hold nothing but U.S. Treasury securities,” recognized as “the safest, most reliable investment worldwide.” [Century Foundation, 1/26/05]

Claim: “The problem that we now face is not one that we can tax our way out of, for a very simple reason: The costs and the current program are growing faster than the underlying tax base. So if we were to raise taxes today to deal with it, and the costs of the program continued to grow faster than the tax base, then in the future, future generations would simply have to come back and raise taxes again.” [Senior White House official, press conference, 2/3/05]

Fact: An alternative proposal by Peter Diamond and Peter Orszag would resolve Social Security’s funding problems directly and permanently through modest tax increases. The Congressional Budget Office states that, “under Diamond-Orszag, the trust fund balance would always be positive and scheduled benefits would be fully financed.” [CBO, 12/22/04]

History

Claim: “Social Security was a great moral success of the 20th century, and we must honor its great purposes in this new century.” [President Bush, 2/2/05]

Fact: Conservatives have been trying to gut Social Security since its inception. Both Barry Goldwater and Ronald Reagan endorsed privatization in 1964. In 1983, the Cato Institute laid out a privatization plan similar to President Bush’s, stating, “We will meet the next financial crisis in Social Security with a private alternative ready in the wings.” [Miami Herald, 2/7/05]

Rhetoric

Claim: “I think it’s important for people to be open about the truth when it comes to Social Security.” [President Bush, 2/4/05]

Fact: The Bush administration has lobbied hard for privatization while being notably closemouthed about the details. [The Washington Post, 2/6/05]

Fact: The Wall Street Journal reports the White House is quietly assembling a coalition of deep-pocketed allies “that will privately raise $35 million for an advertising and lobbying effort to push the politically risky measure through Congress.” [Wall Street Journal, 2/4/05]

Claim: “The role of a president is to confront problems – not to pass them on to a future president, future Congress, or a future generation.” [President Bush, 2/4/05]

Fact: Dick Cheney admits trillions of dollars in future borrowing will be necessary to cover the cost of establishing private accounts. This deficit would have to be repaid by today’s younger workers. [The New York Times, 2/6/05]

Return to top of page

SOCIAL SECURITY – The COST of the PROPAGANDA:

President Bush's 60-day Social Security privatization road show is getting expensive. According to some rough estimates, the drive to sell his pseudo-policy "may be one of the most costly in memory, well into the millions of dollars." Now, "House Appropriations Committee Republicans have quietly asked the administration for an accounting of its '60 Stops in 60 Days' blitz." Additionally, "Rep. Henry A. Waxman (Calif.), the ranking Democrat on the Government Reform Committee, formally asked the Government Accountability Office not only for the cost but also 'whether the Bush Administration has crossed the line from education to propaganda.'"

Read more about the cost in this Washington Post article.

Return to top of page

Honor your Father and Mother

by Jim Wallis

The following is an open letter written by Jim Wallis as convenor of Call to Renewal, a coalition of churches and faith-based organizations working to overcome poverty. The letter was distributed last week to all members of the U.S. Congress as the House and Senate begin hearings on Social Security, and outlines the moral framework with which Social Security should be discussed.

"Honor your father and your mother, so that you may live long in the land..." (Exodus 20:12)

As discussion about Social Security reform begins in the Senate Finance Committee, beware of those who tell you that God spoke to them and they have the "fix" for Social Security. To guarantee the solvency of this bedrock institution in American life will not be easy; it will require our best bipartisan thinking and collaboration. But one aspect of this debate does indeed raise some fundamental moral - and even religious - issues that we ought to consider.

The Judeo-Christian faith tradition has much to say about intergenerational commitments. The Old and New Testaments could not testify more clearly that we must "honor thy father and thy mother" - and care for widows and orphans, the ill, and the disabled. And there is no trust more sacred to biblical faith than the injunctions to care not only for our immediate families but also the larger family of all humanity, especially the least, the last, and the lost. In Jesus' words from Matthew 25, "As you have done to the least of these, you have done to me."

We are commanded to "Honor your father and your mother," which is linked to our own well-being and security, "so that your days may be long in the land that the Lord your God is giving you" (Exodus 20:12). Deuteronomy 5:16 repeats the commandment and adds the motivation "that it may go well with you," again connecting the generations in a mutual sense of responsibility for one another. Proverbs 23:22 tells us to respect the generation that has gone before: "Listen to your father who begot you, and do not despise your mother when she is old." Proverbs 28:24 goes further and warns against any economic ill treatment: "Anyone who robs father or mother and says, 'That is no crime,' is partner to a thug." Ezekiel 22:7 extends the warning to "orphans and widows." The Christian New Testament picks up the same themes and in Matthew reminds us again to "honor your father and your mother." Ephesians 6:1-3 says: "Children, obey your parents in the Lord, for this is right. 'Honor your father and mother,' this is the first commandment with a promise, 'so that it may be well with you and you may live long on the earth.'"

The constant theme is that the well-being of our parents and the next generation is spiritually connected to our own. Social Security is a major way in which our society honors the previous generation by representing a civilized nation's answer to the age-old problem of old-age poverty. This covenant assures the old in our community that growing old should not be a tragedy, and this commitment is strongly interwoven into the fabric of American society. Without Social Security, nearly half of elderly Americans would be in poverty; with it, only 10 percent are. For nearly two-thirds of the elderly, Social Security provides the majority of their income. In addition, over one-third of benefits from Social Security go to non-retirees, increasing opportunity for families facing unpredictable challenges. Social Security helps more low-income children than welfare (TANF), providing support to children who have lost a parent to death or disability. And when a worker becomes disabled or dies, the entire family is protected from poverty by benefits. There are now more than 4.5 million widows and widowers who depend on Social Security.

Privatizing Social Security threatens to dismantle our nation's commitment and breach a covenant held between child and parent, worker and retiree, employed and unemployed, able and disabled. Casting it aside disrespects the biblical covenant. Social Security offers a guarantee of security for the elderly and many others that the stock market can never provide. President Bush's plan to privatize Social Security would take a significant portion out of the Social Security benefits that so many Americans depend upon and divert it for private investment in the stock market. Turning what was a public promise into a private gamble could create a serious breach in the covenant between generations and raises deep questions about the moral priorities of our society. Social Security privatization could easily "rob" mother and father. Our faith requires that we consider carefully how privatization would hurt children, women, and people with disabilities.

Social Security is about we, not me, and us, not I. It is a common thread for the common good, a tie that binds a nation's people together. Social Security is about faithfulness to a covenant between "we the people" not to forsake our parents, grandparents, children, and neighbors. It is a modest but critical bedrock of hope. To go from assuring the elderly and needy of this critical and dependable support to offering "private accounts" is a potential risk to seniors, a boon to the stock market, and an uncertain "prize" for younger generations. Putting our commitment at risk and increasing debt for a transition to a private system has implications for the old and young. For the old, the danger is the anxiety of potential poverty; for the young, the danger is in endangering their own children with massive debt.

Social Security is an expression of national values - and for Christians, our biblical priorities. It is about protecting the American dream, but also honoring God's community by providing opportunity and dignity. Fostering dignity for families, children, and elders in need is the true measure of our compassion, the true measure of our commitment to - and covenant with - the common good. Those who want to radically change a system that has worked so well are saying, in principle, that "me" is better than "we," that private solutions are better than shared responsibility. They want to weaken and shrink the places where we solve problems in common. They would rather each of us seek our own private solution to the issues of security, which always works to the detriment of the most vulnerable.

Honoring the intergenerational covenant has everything to do with our society's moral behavior. We are intimately bound across lines of age, economics, and community. Let us not be a nation where "Father and mother are treated with contempt in you; the alien residing within you suffers extortion; the orphan and the widow are wronged in you" (Ezekiel 22:7).

Return to top of page

Statement: To Preserve and Strengthen Social Security: Religious Organization Statement of Principles

April 26, 2005

We the undersigned religious organizations come from diverse religious traditions, yet our communities speak with one voice on the importance of providing compassionate care for the elderly, widows, orphans, and persons with disabilities. It is the birthright of each person to live a life with dignity and with access to the basic necessities of life. It is because of our deep moral concern for the most vulnerable in our society that many of our organizations actively supported the creation of the Social Security system in 1935 and many of its later improvements.

Today, we celebrate the tremendous success of the Social Security system. For over sixty years, it has provided the foundation for a compassionate society by providing basic economic security for all participants. Its present overall structure--universal, compulsory, an earned right, wage-related rather than means-tested, and protected against inflation--has served our country well. In 2004, the combined programs of Social Security provided benefits to 48 million people B including retirees, survivors, and eight million people living with disabilities. Survivor benefits supported more than five million children. Without this basic income security, over 50 percent of women and 40 percent of men over age 65 would likely be living in poverty. The Social Security system has demonstrated the positive role that government can play in advancing the common good. Future generations deserve nothing less.

It is our common concern for the economic well being of future generations that brings our nation to its current discussion of the future of the Social Security system. It is a timely and appropriate discussion. It warrants careful reflection concerning the basic principles upon which the present system was founded and the moral values which bring us together in common purpose as a nation. We seek to contribute to this discussion by offering the following principles, informed by our moral beliefs and religious experience, as a basis for evaluating proposed changes to the Social Security system.

Compassion. As citizens and residents of this country, we have a collective responsibility to care for one another. The federal government should continue its important, effective, and efficient role promoting a compassionate society through the Social Security system.

Economic security. Social insurance should remain a basic part of our society. Disability and survivor insurance must be maintained. Security for the elderly, survivors, and persons with disabilities should not be left to the vagaries of fragile family support systems, voluntary charity, or economic cycles.

Equity, fairness, and progressivity. The present overall structure of the Social Security system --universal, compulsory employee and employer contributions, an earned right, wage-related rather than means-tested, and protected against inflation--should be preserved and strengthened. Overall, the costs and benefits should be distributed progressively in proportion to each person=s ability to pay and level of need. Care must be given to assure that segments of the population are not systematically disadvantaged due to gender, race, or marital status.

Savings and pensions. Social Security is intended to be the third leg of a three-legged stool, the other two legs being personal savings and employer-provided pensions. Congress should encourage personal savings and employer pensions in addition to (not as a substitute for) the current system, and, especially, it should explore ways to help low- and middle-income households save more for their future.

Stewardship of the public trust. Congress has a moral obligation to fulfill its trust responsibilities to those who have contributed through their payroll taxes to the Social Security trust fund. Congress must also assure that future beneficiaries will receive benefits sufficient to meet their basic needs, that trust fund revenues and expenditures balance over time, and that future generations will not be unfairly burdened by this generation=s debts.

We believe the strength of our country is measured best by the compassion we show to one another in our times of greatest need and vulnerability. In the months ahead, we will continue to look at new proposals to modify the Social Security system through the framework of our moral beliefs and religious experiences. We will seek to engage with members of Congress and the public to help discern the best way to strengthen and preserve the Social Security system so that future generations may continue to benefit, as we do now.

Organizational sign-ons as of April 26, 2005

• African Methodist Episcopal Church

• Call to Renewal

• Church Women United

• Episcopal Church USA

• Evangelical Lutheran Church in America

• Friends Committee on National Legislation

• Jewish Council for Public Affairs

• National Advocacy Center of the Sisters of the Good Shepherd

• National Council of the Churches in Christ in the USA

• National Council of Jewish Women

• NETWORK: A National Catholic Social Justice Lobby

• Presbyterian Church (U.S.A.) Washington Office

• Union for Reform Judaism

• Unitarian Universalist Association of Congregations

• United Church of Christ Justice & Witness Ministries

• The United Methodist Church - General Board of Church and Society

Bush's New Social Security Tactic

By Jim Hightower, AlterNet

Posted on May 11, 2005, Printed on May 12, 2005

read online at http://www.alternet.org/story/21984/

As a result of George, Dick Cheney, and a plague of other big-shot Bushites going on this cross-country flim-flam tour, more Americans now oppose Bush's scheme than before the White House crew ventured out of Washington. So Bush & Company are now trying a new tactic: Class war.

George W. has come out for an arcane proposal he calls "progressive price indexing" as a new way for the government to calculate the amount of your Social Security check when you retire. Striking a populist pose, which is awkward for this elitist, rich son-of-a-Bush, George asserts that his accounting gimmick will fix most of the long-term financing gap in Social Security by cutting the benefits of the rich and increasing those of the poor.

But Mr. George Jennings Bryan is a fraud. The poor would get no increase in benefits under his indexing, and a millionaire's reduction would amount to only one percent, which is insignificant to the rich, since they don't depend on Social Security for their retirement.

The devastating cuts under Bush's "progressive" indexing would come in the retirement checks of the middle class. An average worker earning about $36,000 today would face a 16-percent cut in benefits, while those earning about $58,000 would see a 25-percent cut. The cuts grow more severe for today's youngsters who are not yet in the workforce. Coupled with Bush's privatization scheme, his indexing plan would leave millions of middle-class Americans with a monthly Social Security check at or near zero.

That's George's real goal: Gut Social Security. The rich don't need it, it'll pay zip to the middle class, and it'll become just a poverty program that then can easily be cut by future Bushites. That's not populism--it's cynicism.

Jim Hightower is the best-selling author of Let's Stop Beating Around the Bush, from Viking Press. For more information, visit jimhightower.com.

Return to top of page

return to LiberalWare.com

How many times can President Bush get away with crying wolf? First came the "weapons of mass destruction." Congress believed him and committed our nation to a tragic war in Iraq, based on lies and deception. Then there were the massive tax cuts for the rich, guaranteed to get the economy going again. The result? The budget surplus was traded in for a giant deficit to be passed on to our grandchildren.

How many times can President Bush get away with crying wolf? First came the "weapons of mass destruction." Congress believed him and committed our nation to a tragic war in Iraq, based on lies and deception. Then there were the massive tax cuts for the rich, guaranteed to get the economy going again. The result? The budget surplus was traded in for a giant deficit to be passed on to our grandchildren.